Ethereum has seen mixed price action throughout 2020, with the cryptocurrency first incurring a parabolic uptrend in early-February that led it to highs of $290, before it lost its momentum and reeled all the way down into the sub-$100 region in mid-March.

In the time since this capitulatory decline, ETH has clawed its way back into the mid-$100 region, where it has been consolidating at for the past few weeks.

There are a few key fundamental events that could hold some heavy sway over which direction Ethereum trends throughout the rest of the year, with its success potentially being somewhat dependent on how much dominance it secures over the smart contract platform sector in the coming months.

Ethereum posts 2% quarterly gain despite recent capitulation

Ethereum has been able to post an incredibly strong rebound from its March 12th lows in the sub-$100 region, as the cryptocurrency is currently trading up roughly 50 percent from this point.

Its strong rebound isn’t something that is unique to just ETH, as the aggregated cryptocurrency market has been showing signs of strength throughout the past couple of weeks.

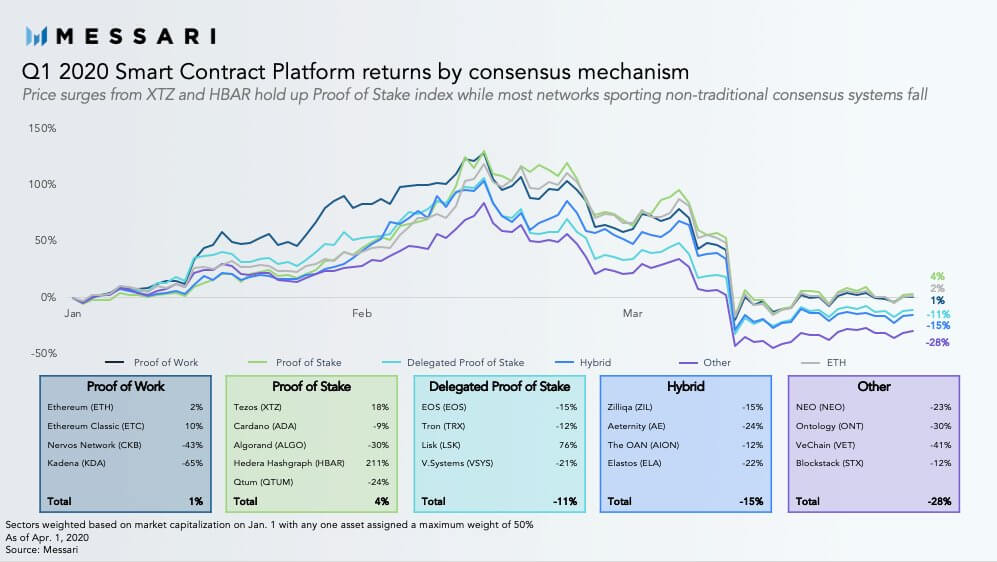

Messari – a research and analytics platform – shared data about the smart contract sector’s performance this quarter in a recent tweet, noting that with the exception of Delegated Proof of Stake tokens (dPOS), Proof of Stake (POS) and Proof of Work (POW) tokens were able to widely climb higher.

“For the foreseeable future, crypto markets appear to be in the unstable hands of the broader economic environment. Despite macro headwinds, the smart contract sector showed signs of recovery heading into Q2 + POW index up 1% + POS index up 4% + dPOS index down 11%.”

Here are the Trends That Could Allow ETH to Consolidate Sector Dominance in Q2

Ethereum could continue to dominate the smart contract market in Q2, as there are a few key trends that may allow it to consolidate its control over this sector.

While referencing points from Wilson Withiam – who conducts research for Messari – they explained in a later tweet that there are three primary trends that could help ETH grow in the months ahead.

“Trends to watch for Q2 from [Wilson Withiam]: + ETH 2.0 will continue to dominate conversation + ‘ETH Killer’ market will become more saturated as more networks launch + Staking markets will continue to be under stress, concentrating power in large validators and exchanges.”

If these trends do allow Ethereum to further harness greater control of the smart contract sector in Q2 2020, it could give the crypto a notable price boost as its fundamental strength grows.

Ethereum, currently ranked #2 by market cap, is up 0.54% over the past 24 hours. ETH has a market cap of $17.41B with a 24 hour volume of $14.71B.

Chart by CryptoCompare

Ethereum is up 0.54% over the past 24 hours.

Posted In: Ethereum, Altcoins, Analysis, Price Watch

The above advertisement is an referral link.

Like what you see? Subscribe to CryptoSlate

Get our daily newsletter containing the top blockchain stories and crypto analysis straight to your inbox.

Cole is a freelance journalist and university student studying philosophy. He focuses primarily on covering cryptocurrency and blockchain-related news. He owns a non-life-changing sum of Bitcoin and enjoys day trading.

Commitment to Transparency: The author of this article is invested and/or has an interest in one or more assets discussed in this post. CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article. Please take that into consideration when evaluating the content within this article.

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.