Zcash and Dash appear to be leading the cryptocurrency market. Despite the recent bullish impulse they went through, a steep correction may be underway.

High correlation and its predictive powers

Over the past month, Bitcoin, Zcash, and Dash have experienced a high correlation regime. Whenever one of these cryptocurrencies moves upwards or downwards the other two tend to follow suit.

Data from CryptoWatch reveals that the bellwether cryptocurrency and these privacy-centric tokens have an average correlation coefficient above 0.73. This numerical measure can be considered as a strong positive linear relationship.

Due to the high levels of correlation between these digital assets, Garry Kabankin, project coordinator at Santiment, was able to spot a pattern that has been occurring since the beginning of the month. According to Kabankin, each time any of the privacy altcoins surges while the flagship cryptocurrency remains stagnant, the market reaches an exhaustion point.

This phenomenon has taken place twice over the last few weeks. The first time it developed was on Apr. 9. Following the bullish momentum that pushed Zcash to a high of $42.2 and Dash to $84.25 while Bitcoin stayed flat, the entire market tumbled.

Similarly, roughly $17.5 billion were wiped off the cryptocurrency market on Apr. 12 after ZEC and DASH topped as BTC consolidated.

The accuracy of these occurrences make Kabankin believe that the privacy tokens’ price action can be used as an “unusual rare indicator” for spotting intermediary tops. Under this premise, it appears that the crypto market could be preparing for a retracement.

A few hours ago, Zcash and Dash’s price jumped 3.9% and 3%, respectively. Meanwhile, Bitcoin kept contained within a narrow trading range.

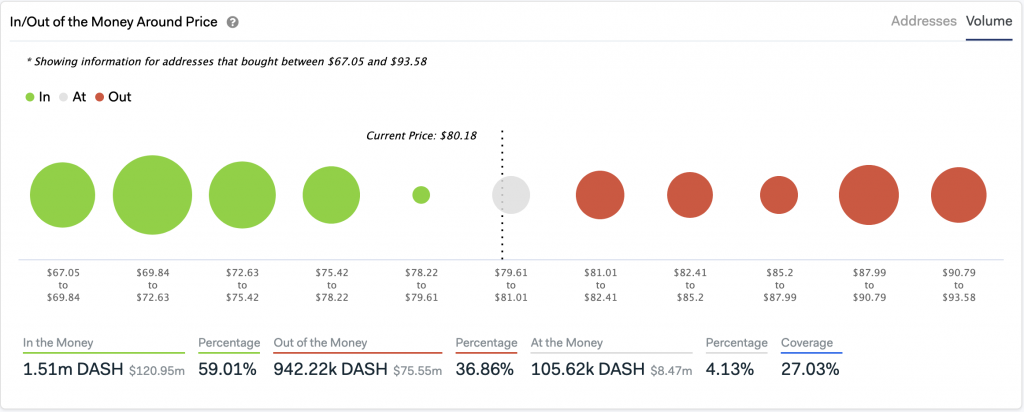

Adding credence to the pessimistic outlook, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model estimates that under the current price levels there is stronger resistance ahead than support for Dash.

More than 13,000 addresses bought over 174,000 DASH between $81 and $82.5. This can be considered a strong supply barrier having in mind that only 12,600 addresses bought 60,000 DASH between $78.2 and $79.6.

Even though it is too early to tell whether or not Kabankin’s hypothesis over the correlation between Bitcoin, Zcash, and Dash is correct, market participants must remain cautious about adverse market conditions given the current global financial landscape.