Chinese flag

Getty

Just a few months since China’s president Xi Jinping announced blockchain as one of the country’s technological priorities and advocated to “seize the opportunity”, there has been a lot of progress on the main blockchain initiatives and most of them will be in production very soon. The ultimate goal is to enable and establish the People’s Bank of China (PBoC) and large Chinese enterprises like Tencent, Huawei, Baidu and Ant Financial as the world leaders in new-breed payments infrastructure with unique features, to undermine the significance of the U.S. dollar as a global trade currency with the launch of Digital Currency Electronic Payment (DCEP) and to establish Chinese blockchain technical standards which will help adopt and scale the technology faster.

Digital Currency Electronic Payment (DCEP) is in the advanced testing phase

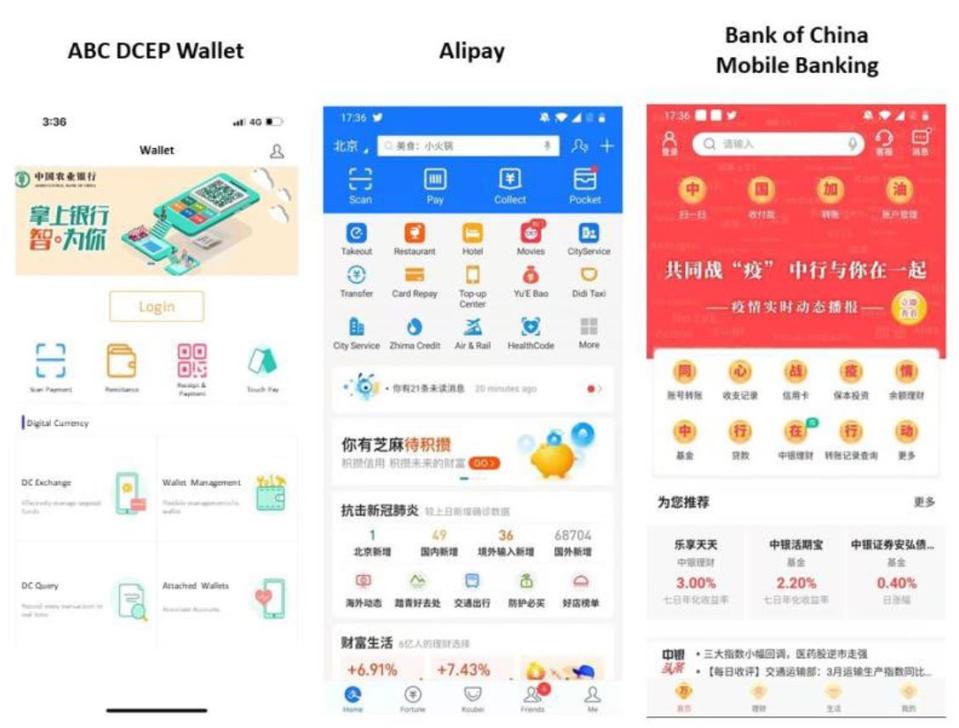

DCEP Wallets

Twitter

Just this week we saw the first mobile wallets that are enabled to work with DCEP as it is already in the advanced testing phase in four Tier 1 and Tier 2 cities: Shenzhen, Xiong’an, Chengdu and Suzhou. The functionality is also interesting as it will have the possibility to send and receive offline payments. DCEP, which is the name of China’s official central bank digital currency (CBDC), is not using a typical blockchain but more of a distributed ledger technology (DLT) style protocol. The digital yuan is currently being tested at Agricultural Bank of China (ABC)’s wallet and it is safe to assume that all of the top four China banks (Bank of China, the China Construction Bank and the Industrial and Commercial Bank of China) are also having access to it. The way that DCEP is designed is that each of the large commercial banks have accounts at PBoC for the digital yuan on one side and are working directly with Alibaba

It is interesting to note that the China’s digital yuan will have a couple of significant differences from its legacy twin. The main one is that storing digital yuan will not generate interest, hence it is to be used only for in/out payments. The second one is the potential speed and reach of the DCEP; in case of emergency and for tax reasons PBoC will have instant access to people’s wallets, even in rural areas.

Blockchain Service Network (BSN) is launching on April 25

BSN Logo

www.bsnbase.com

Another government-related initiative is the Blockchain Service Network, launched in collaboration with large enterprises like China UnionPay, China Mobile Communications Corporation Design Institute and China Mobile Communications Corporation Government, is aimed at providing a robust, low-cost, high-availability, multi-cloud, internet-of-blockchains infrastructure. Some of the already supported blockchain protocols are FISCO-BCOS, supported by WeBank, Huawei, Shenzhen Securities Communications and Tencent; XuperChain, supported by Baidu; and CITA. Here is an interesting part: the way that the BSN is designed, it is to be cross-platform and to support the most popular Western frameworks like Hyperledger Fabric (already supported), Ethereum, EOS and Digital Asset’s DAML. Which means that smart contracts and DApps that already exist in the U.S. can be easily ported and working out-of-the-box on BSN, so things like decentralized finance (DeFi) applications and digital asset exchanges will have instant access to liquidity.

The speed that BSN is expanding is massive and the goal is to have 200 server nodes across China by the end of 2020. The yearly cost of running the service will be around $300–$400 per year for an average blockchain DApp usage.

WeBank’s FISCO-BCOS is integrating Digital Assets’s DAML

With the latest announcement of Digital Asset’s DAML being integrated into FISCO-BCOS blockchain, it opens up a lot of doors for collaboration and expansion. WeBank, China’s first digital bank funded by Tencent has created FISCO-BCOS which is currently the main blockchain platform for more than 10000+ developers and 500+ corporations. On one side, BSN and FISCO-BCOS users will be able to write efficient smart contracts using DAML, the framework already adopted by the Australian Securities Exchange, and on another side DAML’s availability on Amazon Web Services (AWS) cloud will provide a seamless and easy way for Chinese DApp developers to run their applications on AWS and reach Western users.

As predicted last year, China is making giant strides in advancing with blockchain technology. This is forming to be another main technology pillar alongside 5G, artificial intelligence and Internet of Things, and its initiatives are intended to provide new ways to deal with large volumes in payments, communications and high storage availability. Both BSN and DCEP are very well shaped and it seems that they are being executed in a professional and effective manner at scale. Soon China will have the largest live blockchain infrastructure and the Western world will need to pay attention.