Roger Ver claimed in a video recently that he has paid $1,000 in BTC fees for a single transaction many times in the past.

We have often heard of BTC transaction fees being high when the network is experiencing strain. However, stories of someone paying $1,000 in fees for a single transaction are beyond the pale.

$1,000 Fees for Sending BTC?

In a recent video, former Bitcoin .com CEO and Bitcoin Cash

(BCH) fan Roger Ver made a striking claim: He says he has paid $1,000 in fees for a single BTC transaction. Not only once, he said, but “more [times] than I can count.”

” I paid a $1000 in fees for a single transaction on the bitcoin network more than I can count”

Someone please teach @rogerkver how to set custom fees in a wallet

A crypto wallet is a device or app that stores digital assets. Unlike the physical wallet in your back pocket,… More ??? pic.twitter.com/dHVamTkwi4

— Bitcoin Meme Hub ? (@BitcoinMemeHub) April 16, 2020

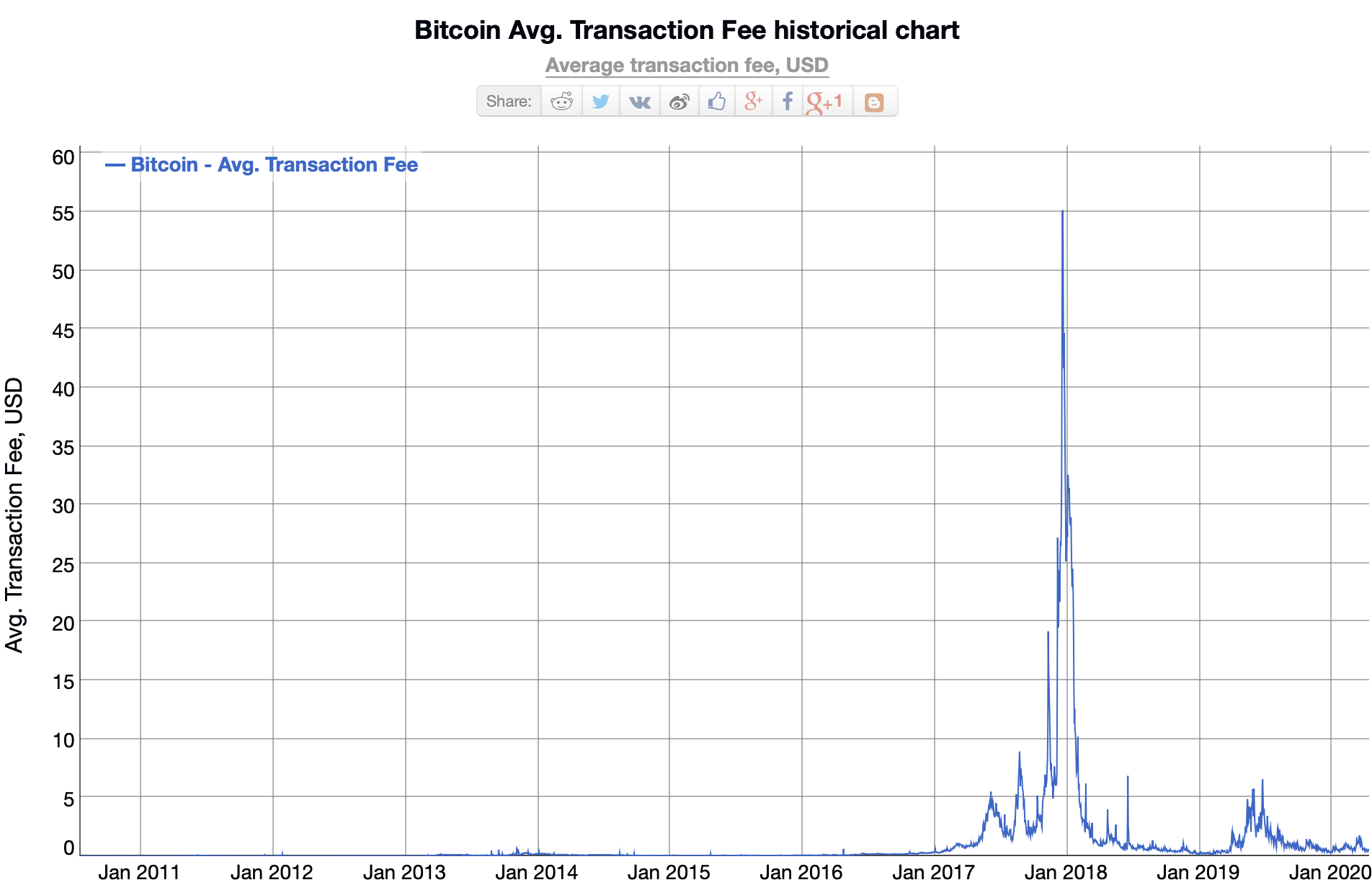

The story is hard to believe. According to on-chain metrics, average transaction fees have never been higher than $55, which was recorded in January 2018.

It seems unlikely that anyone would need to pay more than $100 in BTC transaction fees ever, let alone $1,000. Something doesn’t add up. Could it be that Ver made a mistake and simply did not set a custom fee when sending his transactions? Or is he simply making it all up?

Too Cheap or Too Expensive?

Roger Ver has flip-flopped on the question of Bitcoin fees in the past, so his comments are not surprising. In February 2020, BeInCrypto reported that Ver claimed the opposite: apparently BTC fees were “unfairly cheap.” He said it was disincentivizing miners.

However, he now claims that he has paid far too much—$1,000 for a single transaction—not once, but many times.

Ver is known for being one of the leading advocates for Bitcoin Cash (BCH) and was heavily involved in the BTC fork from the beginning. In August, he stepped down as CEO from Bitcoin.com on amicable terms. The organization, however, continues to promote Bitcoin Cash. In November, it announced a Bitcoin Cash Ecosystem Fund of $200M to boost development on the network.

The contradictory statements are confusing, and it’s unclear whether Ver is simply just pushing an agenda. When looking at on-chain metrics, his accusations simply do not square up with reality.

Do you want to Be In Crypto?Join our Telegram Trading Group for FREE Trading Signals,a FREE Trading Course for Beginners and Advanced Tradersand a lot of fun!

Images courtesy of Shutterstock, Trading View and Twitter.

Disclaimer. Read MoreRead Less

As a leading organization in blockchain and fintech news, BeInCrypto always makes every effort to adhere to a strict set of editorial policies and practice the highest level of journalistic standards. That being said, we always encourage and urge readers to conduct their own research in relation to any claims made in this article.

This article is intended as news or presented for informational purposes only. The topic of the article and information provided could potentially impact the value of a digital asset or cryptocurrency but is never intended to do so. Likewise, the content of the article and information provided within is not intended to, and does not, present sufficient information for the purposes of making a financial decision or investment. This article is explicitly not intended to be financial advice, is not financial advice, and should not be construed as financial advice. The content and information provided in this article were not prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making any investment decisions.

The author of this article may, at the time of its writing, hold any amount of Bitcoin, cryptocurrency, other digital currency, or financial instruments — including but not limited to any that appear in the contents of this article.