An organization providing a non-custodial Bitcoin

BUY NOW loan platform has joined up with some of the blockchain industry’s biggest names to raise funds to build a native decentralized finance (DeFi

BUY NOW loan platform has joined up with some of the blockchain industry’s biggest names to raise funds to build a native decentralized finance (DeFi Decentralized Finance (DeFi) is a term that is being used to describe the world of financial services that are increasingly… More) solution for Bitcoin.

Decentralized Finance (DeFi) is a term that is being used to describe the world of financial services that are increasingly… More) solution for Bitcoin.

Atomic Loans has raised $2.45 million in a seed round led by venture startup firm Initialized Capital. The funding round included Ethereum

BUY NOW blockchain-solutions provider ConsenSys and digital-asset investment firm Morgan Creek Digital, among others.

BUY NOW blockchain-solutions provider ConsenSys and digital-asset investment firm Morgan Creek Digital, among others.

DeFi for Bitcoin

Atomic Loans is essentially a platform that enables a two-sided marketplace for Bitcoin-backed lending. Users can lock their BTC natively in a non-custodial escrow on the Bitcoin chain and borrow stablecoins such as DAI or USDC. It works similarly to regular Ethereum-based DeFi lending platforms — but with Bitcoin.

The three-man team started the venture a year ago just as Ethereum-based DeFi was taking off. Realizing that Ethereum Blockchain is a digital ledger that’s used for storing data on several servers across the world in a decentralized, trustless… More had the advantage of scripting languages and smart contracts, the team wanted to bring something similar for Bitcoin — and this seed round is its genesis.

Blockchain is a digital ledger that’s used for storing data on several servers across the world in a decentralized, trustless… More had the advantage of scripting languages and smart contracts, the team wanted to bring something similar for Bitcoin — and this seed round is its genesis.

The announcement summarized the current situation with a snippet from Anthony Pompliano’s ‘Off the Chain’ newsletter, stating that Bitcoin has been proven as a currency whereas the financial services infrastructure is unproven in a decentralized form. Conversely, Ethereum is unproven as a currency but has a proven DeFi ecosystem.

Partner at ConsenSys Labs, Min Teo, stated that Bitcoin will be a core component of DeFi activity, adding:

The vision of creating a parallel financial system that is permissionless and open to all is one that transcends across chains and communities…

Pompliano himself applauded the venture, adding that:

Atomic Loans is building the decentralized financial infrastructure that uses Bitcoin how it was intended.

Thrilled to be backing @Atomic_Loans as they bring DeFi to Bitcoin.

Go check them out! ?https://t.co/qjGbNbG0j0

— Pomp ? (@APompliano) April 14, 2020

The Status of DeFi, Today

The current status of the decentralized finance industry is heavily weighted towards Ethereum — but a Bitcoin DeFi ecosystem would be complementary, rather than competitive.

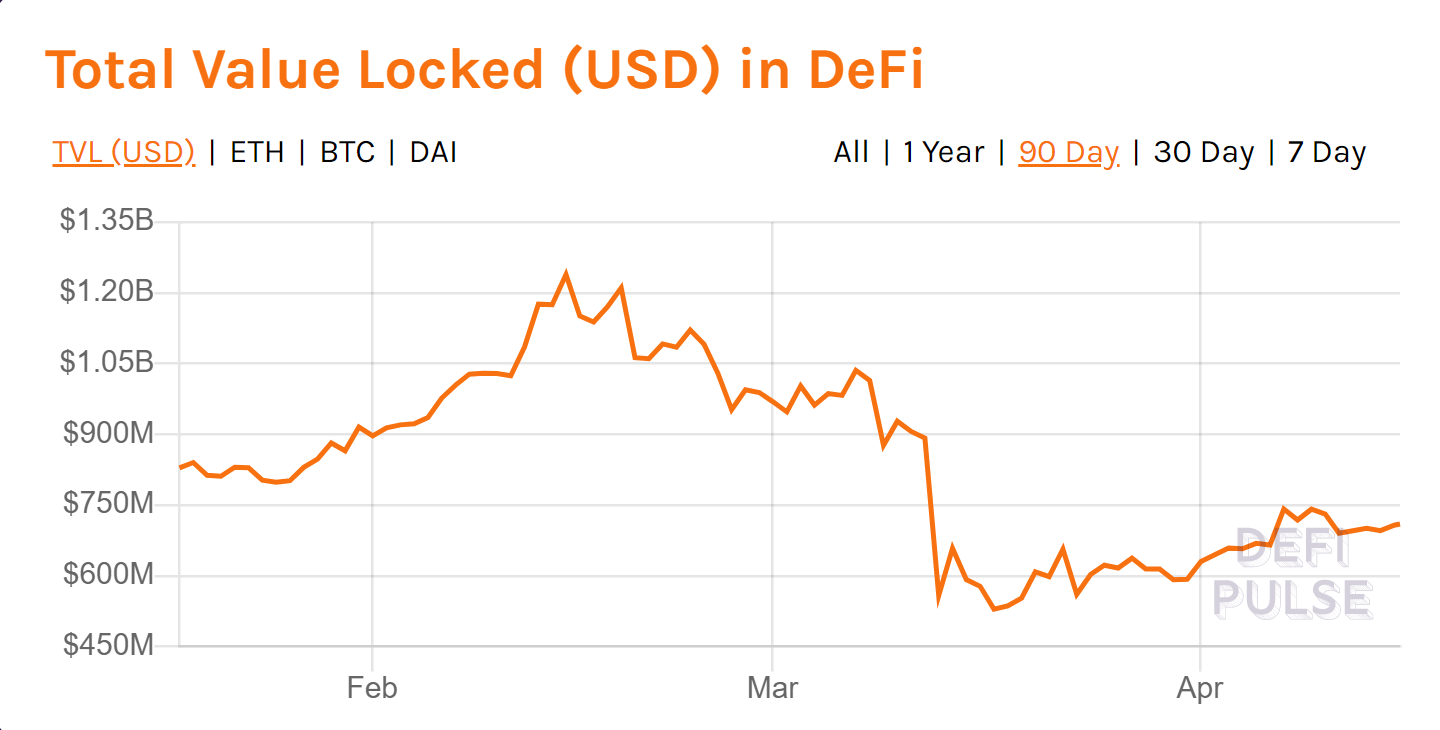

According to Defipluse.com, there is currently 2.7 million ether locked in DeFi protocols as collateral for decentralized lending and borrowing. In terms of total value locked in USD, the figure is at $713 million.

The dollar value has fallen in tandem with the price of Ethereum, which fell off the digital cliff last month during the COVID-19-induced market crash. The all-time high for DeFi dollar lockup was $1.24 billion in mid-February, a figure that has surged 330 percent since the same time the previous year. Since the peak, however, DeFi markets have contracted by 42 percent as collateral is liquidated.

Do you want to Be In Crypto?Join our Telegram Trading Group for FREE Trading Signals,a FREE Trading Course for Beginners and Advanced Tradersand a lot of fun!

Images courtesy of Shutterstock, Trading View and Twitter.

Disclaimer. Read MoreRead Less

As a leading organization in blockchain and fintech news, BeInCrypto always makes every effort to adhere to a strict set of editorial policies and practice the highest level of journalistic standards. That being said, we always encourage and urge readers to conduct their own research in relation to any claims made in this article.

This article is intended as news or presented for informational purposes only. The topic of the article and information provided could potentially impact the value of a digital asset or cryptocurrency but is never intended to do so. Likewise, the content of the article and information provided within is not intended to, and does not, present sufficient information for the purposes of making a financial decision or investment. This article is explicitly not intended to be financial advice, is not financial advice, and should not be construed as financial advice. The content and information provided in this article were not prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making any investment decisions.

The author of this article may, at the time of its writing, hold any amount of Bitcoin, cryptocurrency, other digital currency, or financial instruments — including but not limited to any that appear in the contents of this article.