The second week of April continued to be favorable for the collective crypto-industry. In fact, the sum total of the crypto-market’s market cap rose from $185 billion to briefly touch the $200 billion mark. At the time of writing, however, the figure was down to $195 billion following Bitcoin’s fall below the $7000 mark.

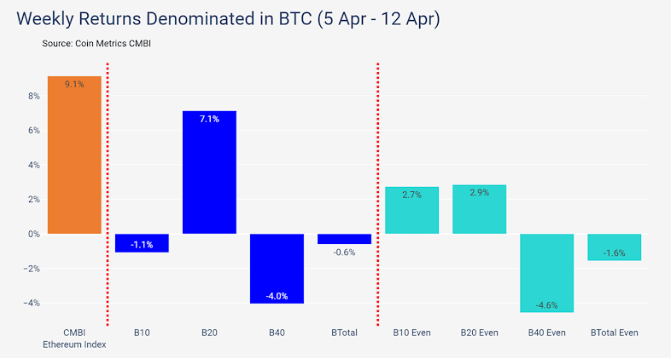

Now, according to the latest Coinmetrics State of the Network report, all CMBI and Bletchley Indexes were found to be positive for a third consecutive week on the charts. It should be noted, however, that the aforementioned recovery has not been enough to cover the losses of mid-March just yet, despite the fact that it is making commendable ground in this regard.

Source: Coinmetrics

The report suggested that the CMBI Ethereum Index was the strongest performer, outperforming Bitcoin’s index by almost 10 percent on the charts. Ethereum accrued returns of around 14.5 percent, in comparison to Bitcoin’s 4.9 percent.

Ethereum’s recovery over the week was also noted in terms of its correlation with Bitcoin. Since the market crash of 13 March, Ethereum has been strongly following Bitcoin on the charts, surrendering its movement to the king coin. However, since attaining a bit of stability, Ethereum has been able to navigate itself within the market, sometimes independently of Bitcoin.

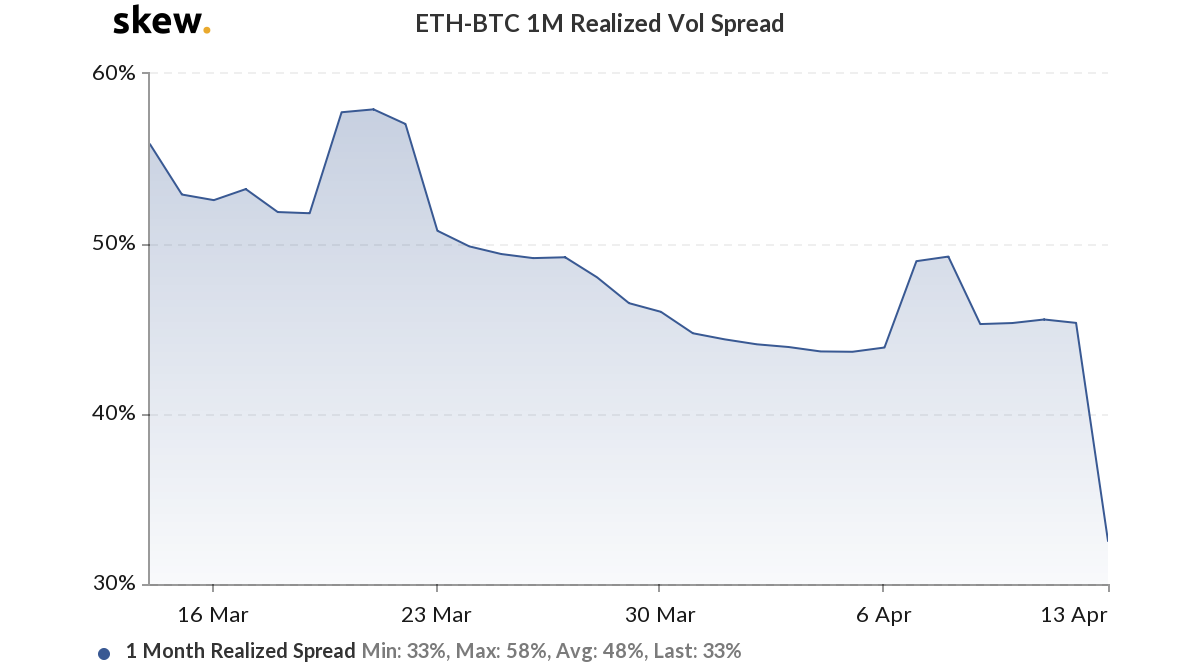

The realized volatility of Ethereum, with respect to Bitcoin, also registered a depreciation over the past 48 hours, according to the chart attached below.

Source: Skew

The report further highlighted that mid-cap crypto-assets were the best performing market size group and the Bletchley 20 index was the only market-weighted index to outperform Bitcoin on the charts. With a recorded growth of 12.4 percent, B20 dwarfed Bitcoin’s CMBI index by 4.9 percent.

Source: Coinmetrics

Further, according to Weiss Crypto Ratings, Cardano and IOTA were the best-performing mid-cap crypto-assets over the past week as both the tokens received a better performance grade that the other mid-cap assets. Stellar and TRON played second fiddle over the week in terms of market growth.