The world’s largest cryptocurrency, Bitcoin sustained a major pullback after a strong surge over the past weeks which propelled the market cap of the entire cryptocurrency market to $195 billion while the king coin’s dominance slid to 64.1%.

Source: CoinStats

The price movement of Bitcoin has been closely mimicked by other peer cryptos, such as Litecoin, Chainlink, Dogecoin, with correlation coefficients of 0.88, 0.64 and 0.68 respectively; these alts have also seen notable declines following the latest downside correction.

Litecoin [LTC]:

Source: LTC/USD on TradingView

A bullish recovery could be around the corner for LTC. At press time, the silver crypto was priced at $42.18 after a minor decline of 0.91% over the last 24-hour as it held a market cap of $2.72 billion and a 24-hour trading volume of $3.30 billion.

Resistance: $63.34, $83.35

Support: $30.79

MACD: The MACD line above the signal line depicted a bullish phase for the coin.

Chaikin Money Flow: The CMF also aligned with the bulls depicting an inflow of capital in the LTC market in the near-term.

Chainlink [LINK]:

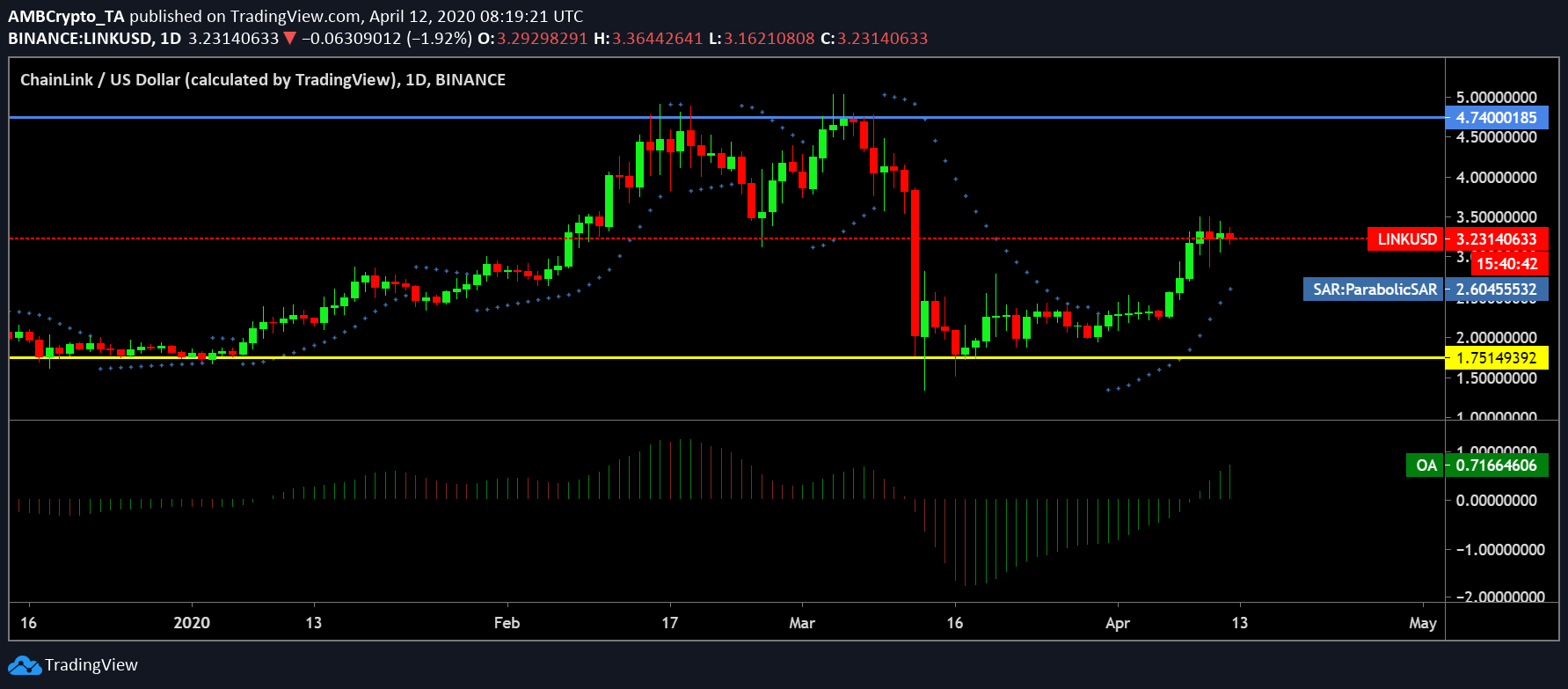

Source: LINK/USD on TradingView

Over the last couple of months, Chainlink has forged notable partnerships which has positively impacted the coin’s price. LINK was valued at $3.23 after falling by 3.3% over the past 24-hours. At press time, it registered a market cap of $1.12 billion and a 24-hour trading volume of $575.6 million.

Resistance: $4.74

Support: $1.75

Parabolic SAR: The dotted markers below the LINK price candles indicating a bearish phase for the coin.

Awesome Oscillator: The closing green bars also suggested a bullish trend for LINK.

Dogecoin [DOGE]:

Source: DOGE/USD on TradingView

Dogecoin [DOGE] rallied steadily above the $0.003-mark after breaching major psychological resistances along the way. DOGE has been in a consolidation phase currently despite minor pullbacks.

The popular memecoin was valued at $0.0019 after a fall of 0.48% over the last 24-hours. Additionally, DOGE recorded a market cap of $244.1 million and a 24-hour trading volume of $164.2 million.

Resistance: $0.0025, $0.0019

Support: $0.0014

Klinger Oscillator: KO depicted a bearish picture for the coin.

Relative Strength Index: RSI, however, was well above the 50-median line which suggested a positive trend among the investors in the DOGE market.