Get Forbes’ top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

Getty Images

CRYPTO MARKETS

Bitcoin surged to its highest level in more than a month Thursday morning, with market analysts optimistic that its bull run will continue. Futures contracts are trading at a premium compared with spot prices, generally a sign of near-term upside, and prices have doubled since their low point in early March. Other cryptocurrencies enjoyed slight gains late in the week as well.

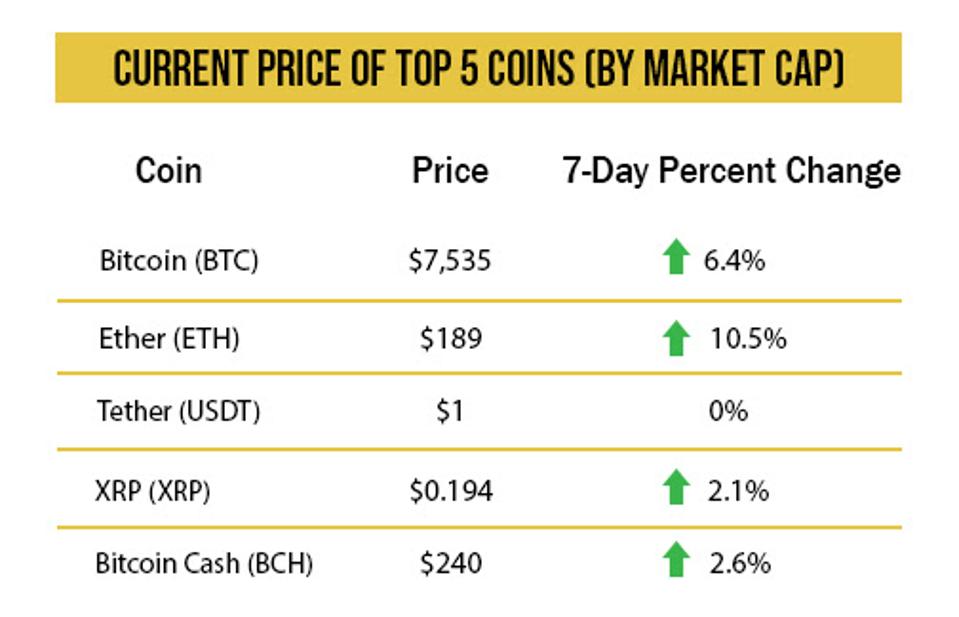

Source: Messari. Prices as of 4:00 p.m. on April 24, 2020

PAYING FOR BIG MACS

The People’s Bank of China released a list of companies that will be test sites for its national digital currency in the near future, and it includes some familiar names. Starbucks

VENMO FOR BITCOIN

Nigeria-based app Bundle launched this Thursday, aiming to get more people in Africa to exchange money using cryptocurrencies. Funded by Binance, the payments app is similar to Venmo and will allow users to send, receive and spend bitcoin, ether and the Nigerian naira with little more than the recipient’s phone number. Founder Yele Bademosi dropped out of medical school to try to make global finance more accessible in Africa, where he estimates only 1.4 million of the 1.2 billion people living there already use crypto.

STIMULUS DEPOSITS IN CRYPTO

Although most Americans are using their $1,200 stimulus checks from the government on essential expenses like bills, essentials and emergency savings, data from Coinbase shows that some are investing their entire check in bitcoin and other cryptocurrencies. Coinbase CEO Brian Armstrong tweeted that the number of deposits of exactly $1,200 more than tripled on the exchange since the IRS began distributing the cash last week, and CoinDesk reported that Binance was showing similar data.

If stimulus check recipients had invested their $250 stipend during the last recession in 2009 in bitcoin when the cryptocurrency was still in its infancy and almost worthless, that investment would be worth hundreds of millions now. They can only hope that this investment is a fraction as successful.

WHAT’S NEXT?

Markets crashed in March as individuals and institutions scrambled to liquidate their assets, and that often included their cryptocurrency portfolios as prices sharply tumbled. Now, with the Federal Reserve taking drastic measures to revive the economy, stablecoins like Tether the dollar-backed USDC have seen an uptick in volume.

The next few weeks will be pivotal for bitcoin leading up to its halving scheduled for May 12. Bitcoin’s price rose significantly in the 12 months following its previous halvings, which occur once every four years, though its counterpart litecoin is down 70% since its halving last year after a frenzied run-up leading up to the event.

ELSEWHERE

How a Crypto Guru Shaped Harvard’s Roadmap for Reopening the US Economy [CoinDesk]

The pandemic was bitcoin’s chance to shine. It hasn’t… yet [Wired]

Bitcoin maven Toni Lane Casserly, ‘Joan of Arc of blockchain,’ dead at 29 [New York Post]