Bitcoin price flipped bullish at the beginning of this week cementing the bulls’ position on the market. Higher price action reclaimed support above $7,000 and extended the bullish leg above $7,400. Although, buyers pushed higher, the resistance at $7,500 remains unconquered.

Bitcoin price confluence levels

The confluence detector shows Bitcoin bullish action lagging behind the initial resistance at $7,332 as highlighted by the SMA 100 15-minutes, the previous high 15-mins, the Bollinger Band one-day upper curve and the Fibonacci 61.8% one-day. If the bulls manage to clear this level’s resistance, they must brace for more hurdles at $7,408, which happens to the tipping point for BTC. Extended action above $7,408 will boost the price towards $8,000, however, if Bitcoin stalls, it could be ammunition for the bears, likely to force Bitcoin under $7,000.

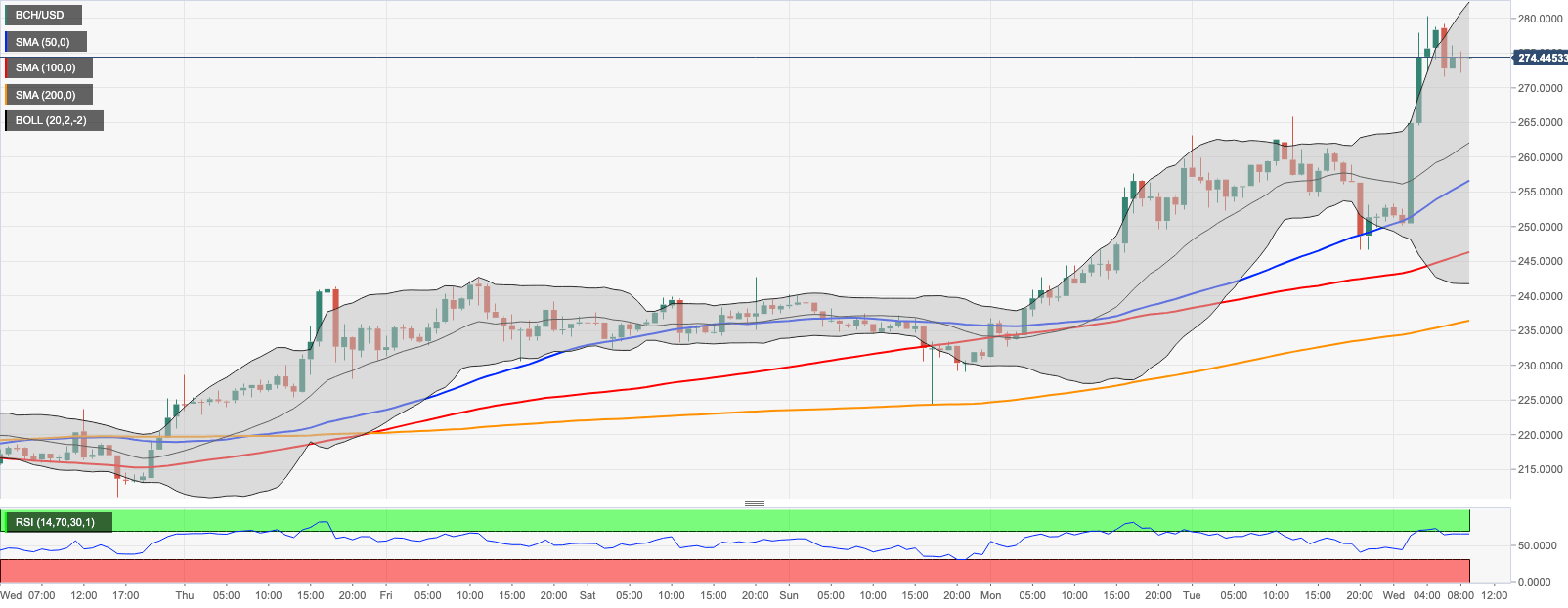

Bitcoin Cash is changing hands at $274.52, off the recent high of $280.38. The fifth-largest digital asset with the current value of $5 billion has been growing sharply ahead of the halving; however, the inability to settle above $280.00 may trigger the downside correction.

Litecoin (LTC) is changing hands at $46.30. The 7th largest digital asset with the current market value of $3 billion has retreated from the recent high of $47.69, though it is still 2.5% higher from this time on Tuesday.

-637219291917785550.png)